Houses for Sale Under $200K: Affordable Home Buying Guide for 2025

Imagine owning your own home yes, yours, not a rental with a budget under $200,000. It sounds ambitious in today’s market, but believe it or not, there are real properties out there that deliver solid value, and the opportunity is yours if you know how to pick wisely.

1. Why aim for homes under $200K?

For many buyers, first timers, downsizers, or investors a price point below $200,000 offers a realistic doorway into home-ownership. With the national median home price now in the $400K+ range, finding entry-level homes represents a strategic way to grow equity without stretching finances.

Focusing on this budget forces clarity: you’ll be looking at value, condition, location, and long-term potential in sharper focus than chasing luxury.

It also encourages smart trade-offs: maybe fewer square feet, maybe a neighborhood with upside rather than top-tier prestige—but with room to build value.

2. Where are the best markets for ≤ $200K homes?

Rather than investing blindly, the data shows some regions consistently offer more listings under $200K, and better conditions for buyers.

- Certain cities still have large inventories of homes under $200K for example, Detroit, Michigan has thousands of listings under that threshold, though with caveats around condition and location.

- According to recent survey data, metros like Youngstown, Ohio (median ~ $163K) and Peoria, Illinois (~ $141K) are still clear options for sub-$200K homes.

- Additional cities: Many mid-west,and Rust Belt destinations provide more breathing room for a budget-conscious buyer.

Takeaway: If your budget is under $200K, shifting attention from overheated coastal markets to more affordable metros may unlock far better value.

3. What to look for: 8 critical checkpoints

When you’re shopping at this budget, the margin for error is slim. Your decision-making must be sharp.

- Location & neighborhood fundamentals

- Safety, schools (if relevant), commute, amenities.

- Even if price is low, a declining or risky neighbourhood undermines value.

- Condition of the property

- Does the home need major repairs (roof, foundation, wiring, plumbing)?

- A cheap price isn’t a deal if you’ll pour tens of thousands into it.

- Size & layout

- Under $200K doesn’t mean minimal; in some places you can get 3-4 bedrooms. For example, in Detroit there are homes listed for $145K-$200K with 3-4 bedrooms.

- Future market potential

- Is the region growing or shrinking? Are jobs coming in?

- Affordability is great—but stagnant or declining markets carry risk.

- Financing & total cost burden

- Down payment, monthly mortgage, property taxes, insurance, maintenance: keep total payment manageable.

- One study estimated a $200K home with 10% down in many places might cost ~$1,200/month, much lower than national averages.

- Resale and liquidity

- If you need to move, will you be able to sell without losing money? Are there many buyers in that price range?

- Markets with lots of homes under $200K might have more competition among sellers.

- Hidden costs & maintenance backlog

- Older homes often carry deferred maintenance. Factor in realistic repair budgets.

- Opportunity vs. risk balance

- A house under $200K can be a brilliant value—but only if you’ve done homework. Cheap can also mean compromised. One commentary noted: “Just because a house is listed at a cheap price does not mean it’s a good value.”

4. A step-by-step strategy for house-hunters under $200K

Step 1 – Set your budget and parameters.

- How much down payment can you afford? What monthly payment is comfortable?

- Factor in moving costs, inspection, closing fees.

Step 2 – Choose target regions.

- Use the data above to focus on metros with stronger inventories under $200K.

- Prioritize those where job growth, amenities and population trends are acceptable.

Step 3 – Build a shortlist of properties.

- Use filters: price ≤ $200K, 2-4 bed (depending on need), acceptable commute/time.

- Schedule visits, take notes.

Step 4 – Get inspection, talk about condition.

- Always inspect. If major systems are failing (electrical, structural), the “deal” might cost you later.

- Ask questions: How old is the roof? Foundation issues? Past floods? Neighborhood crime trends?

Step 5 – Evaluate total cost and exit plan.

- Estimate monthly payment on loan + taxes + insurance + maintenance.

- Ask: If I sell in 5-10 years, what are the prospects in this area?

- Make sure you’re comfortable even if appreciation is modest.

Step 6 – Make a competitive offer—but with margin.

- In affordable markets, there still may be competition. Don’t pay full freight for “fixer” status.

- Retain a buffer for repairs or upgrades.

Step 7 – Close, then plan upgrades and maintenance.

- Once you own it, set aside a maintenance fund.

- Prioritize upgrades that boost value (kitchen, bathrooms, exterior curb appeal).

5. Common pitfalls (and how you avoid them)

- Assuming low price = great value → Instead, treat it as a starting point for value, not guarantee.

- Ignoring long-term market fundamentals → A cheap house in a shrinking region may never appreciate.

- Under-budgeting for repairs → One Reddit buyer noted: “Everything … is a piece of literal garbage … yet ALL of them … are charging double or even triple what the house was worth.” Reddit

Be realistic. - Overlooking total cost (taxes, insurance, HOA, upkeep) → These can kill affordability.

- Neglecting resale potential → If you buy a home you love but others won’t want, you could be stuck.

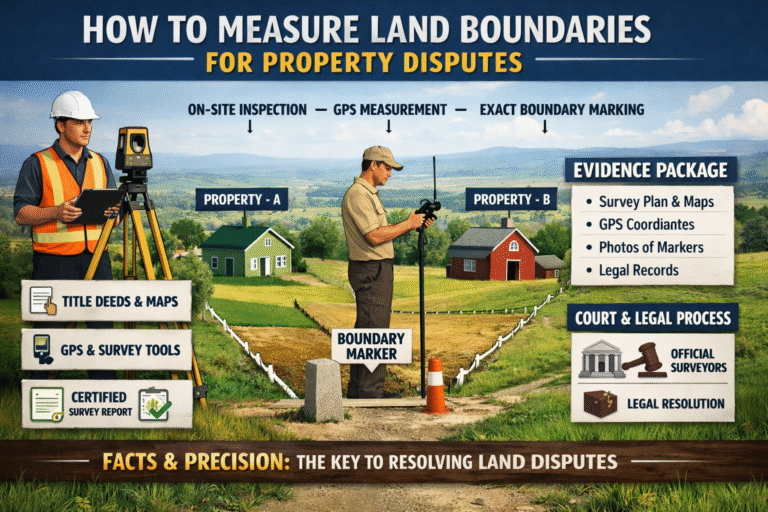

Know the Exact Land You’re Buying

When searching for homes under $200K, every square foot matters. That’s where Land Measure helps you make confident decisions. Our advanced land measurement tools allow you to:

- Instantly verify plot size, boundaries, and property dimensions.

- Compare listed data with accurate satellite and GIS measurements.

- Understand the true value per square foot before making an offer.

Whether you’re buying a compact city home or a suburban lot, our precision tools ensure you never overpay for hidden or misreported land.

Land Insights That Reveal Hidden Value

Many affordable homes are built on irregular or underutilized plots. The Land measure gives you a clear visual of:

- Exact land shape and usage potential (ideal for expansions or backyard planning).

- Legal boundaries and access points to avoid disputes.

- Topographic and zoning data, helping you understand what’s allowed on your property.

This level of insight helps buyers spot undervalued homes others might overlook — especially in the sub-$200K range.

Make Smarter Real Estate Choices with Trusted Data

Every successful home purchase begins with the right data. With The Land Measure, buyers and investors can:

- Cross-check listing claims with verified land data.

- Identify future growth zones and land value trends.

- Download accurate property reports before committing to a deal.

In a competitive housing market, data-driven buyers win.

the land measures gives you the clarity and confidence to invest smarter — and within your budget.

7. Final thoughts

If you’re looking to purchase a home for under $200,000, you’re not chasing impossibility—you’re entering a smart, value-focused strategy. It’s about clarity: budget, region, condition, future.

Take nothing for granted. Do your homework. Know the numbers. And when you find that home that passes all the checks, you’ll have made a decision that’s both financially sound and personally meaningful.

Because owning a home under $200K isn’t just about price—it’s about your place to call your own, to build equity, and to step into the next chapter.

Frequently Asked Questions

1. Can I really find a good house under $200K in 2025?

Yes, absolutely — but location matters. While big coastal cities like New York or San Francisco rarely have listings under $200K, many Midwest and Southern states (e.g., Ohio, Michigan, Alabama, Texas) still offer move-in-ready homes in this range. You’ll often trade off square footage or neighborhood prestige, but value and affordability can still be excellent.

2. What kind of homes can I expect in this price range?

For under $200K, you’ll typically find:

- Single-family starter homes (2–3 bedrooms) in smaller cities or suburbs

- Townhouses or condos in mid-sized metro areas

- Fixer-uppers or older properties in larger cities

The key is condition — always prioritize structurally sound homes with potential to build value over time.

3. Are homes under $200K usually in bad condition?

Not always. While some lower-priced homes may need upgrades, others are move-in ready—especially in markets where cost of living is lower. Always schedule a professional inspection to uncover hidden issues like plumbing, roofing, or foundation damage before closing.

4. How can I finance a $200K home with limited savings?

There are several accessible loan options:

- FHA loans: Require as little as 3.5% down payment.

- USDA loans: 0% down payment in eligible rural areas.

- VA loans: 0% down for veterans and active-duty service members.

You can also explore first-time buyer grants or state programs that help cover down payments and closing costs.

5. How much monthly payment will a $200K home cost me?

It depends on your down payment, loan term, and interest rate. For example:

- With a 10% down payment and a 6.5% interest rate on a 30-year mortgage, the monthly payment is roughly $1,200–$1,300, including taxes and insurance.

Using a mortgage calculator will help you get an accurate figure for your specific scenario.

6. Are these homes good for investment?

Yes — lower-priced homes often offer higher rental yield and faster ROI if located in growing markets. For example, properties in states like Tennessee, Indiana, and Ohio have shown strong rental demand and appreciation potential. Just ensure the area has stable job growth, good schools, and low vacancy rates.

7. What are common mistakes buyers make when purchasing under $200K homes?

Some of the biggest pitfalls include:

- Ignoring inspection reports or skipping due diligence

- Underestimating repair and renovation costs

- Choosing a declining neighborhood for the sake of cheap pricing

- Failing to budget for taxes, insurance, and maintenance

Being patient and informed will save you thousands later.

8. How can I find reliable listings for homes under $200K?

Use trusted sites like:

- Realtor.com

- Zillow

- Redfin

Set filters to “Price: Max $200,000” and enable alerts for new listings in your preferred city or ZIP code. Working with a local real estate agent can also help you access off-market or early listings.

9. Is it better to buy a fixer-upper or a ready home under $200K?

If you have renovation skills or access to affordable contractors, a fixer-upper can deliver higher returns through value appreciation. But if you’re a first-time buyer or short on renovation budget, a move-in-ready home is safer. The right choice depends on your financial comfort and long-term plan.

10. Will home values under $200K appreciate over time?

Yes — provided you choose the right location and maintain the home well. Affordable housing demand is strong nationwide, especially as prices rise in major cities. Buyers who enter the market now in growing regions could see steady appreciation over the next 5–10 years.

One Comment